CYCLE TESTED. MARKET KNOWLEDGE. REMAIN FOCUSED.

Menlo Equities has managed $6.7 billion of assets since inception. Investing in commercial real estate is a cyclical business. Our goal is to create value and generate superior, risk-adjusted returns for our partners through our three investment platforms: core-plus, value-add, and development.

Regardless of where we are in the cycle, or through which platform we deploy capital, our investment focus remains consistent: invest only in high-quality data center, infill logistics, life sciences, office and R&D buildings in the most robust technology-driven markets, which we believe have proven themselves to outperform on a comparable basis.

Our core-plus strategy seeks to deliver a low-risk, stable cash flow yield, with the potential for appreciation by investing in high-quality properties leased long-term to creditworthy tenants in tech-centric markets that have historically outperformed through market cycles.

- Well-located, income-generating real estate likely to stay leased throughout the market’s cycle and gradually appreciate

- Class-A improvements

- Located in gateway cities and/or high-demand knowledge hubs

- Target leverage: 30% to 50% LTV

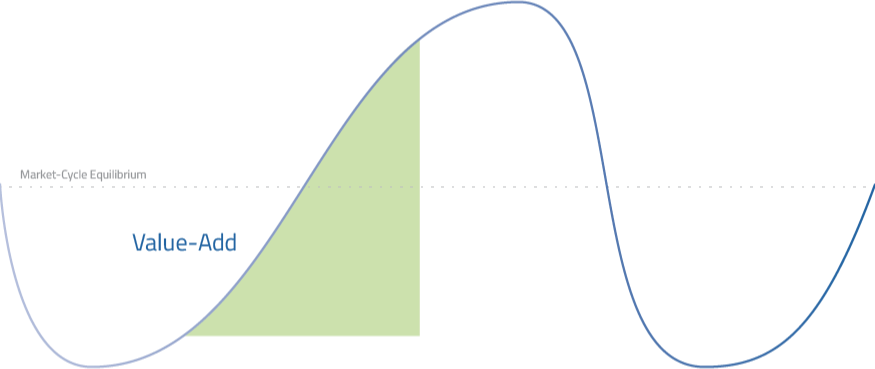

Our value-add strategy seeks to create value from the repositioning of properties achieved through capital enhancements and/or hands-on property management.

- In-place rental rates typically well below market

- Existing improvements may be dated or obsolete

- Acquisition price typically below replacement cost

- Target leverage: 50% to 70% LTV

Typically executed in a joint venture with Menlo as the managing partner, our development strategy includes entitlement, ground-up development and redevelopment from concept through site acquisition, construction, lease up and exit.

- Driving growth through ground-up development and build-to-suit for leading technology firms

- Menlo’s vertically integrated platform drives the entire development process from site acquisition, planning, entitlements, design, construction management and disposition

- In-house operations enable us to quickly adapt to the market cycle and market trends, ensuring we are well positioned to execute our strategy

- Focus on infill locations

- Target leverage: 60% to 75% LTV

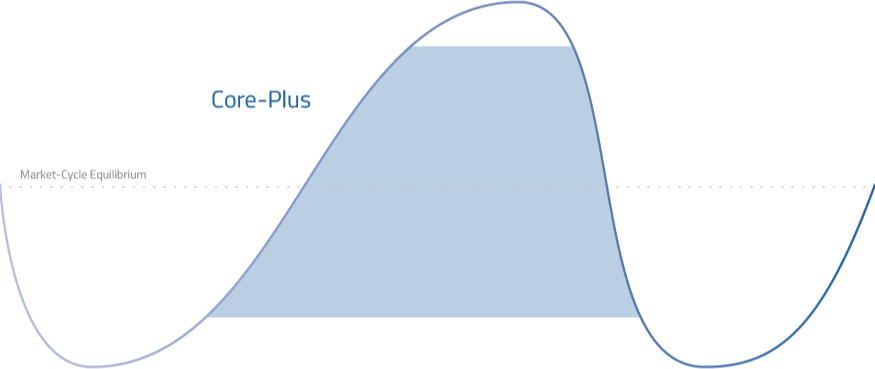

CORE-PLUS

Our core-plus strategy seeks to deliver a low-risk, stable cash flow yield, with the potential for appreciation. We achieve this by investing in high-quality properties leased long-term to creditworthy tenants in tech-centric markets that outperform through market cycles.

- Well-located, income-generating real estate likely to stay leased throughout the market’s cycle and gradually appreciate

- Class-A improvements

- Located in gateway cities and/or high-demand knowledge hubs

- Target leverage: 30% to 50% LTV

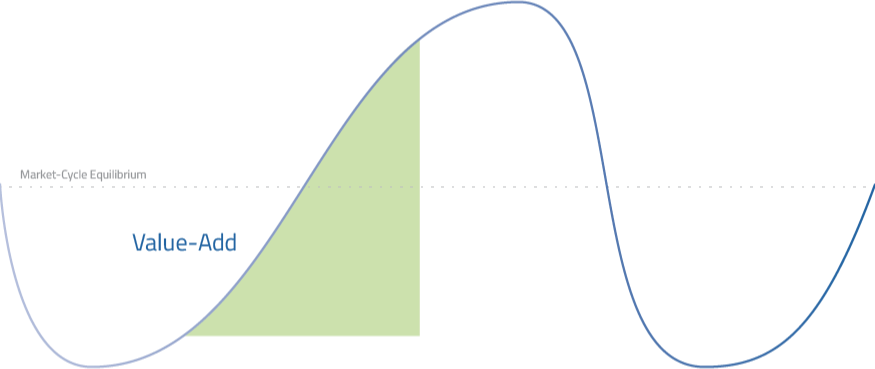

VALUE-ADD

Our value-add strategy seeks to create value from the repositioning of properties achieved through capital enhancements and/or hands-on property management.

- In-place rental rates typically well below market

- Existing improvements may be dated or obsolete

- Acquisition price typically below replacement cost

- Target leverage: 50% to 70% LTV

DEVELOPMENT

Typically executed in a joint venture with Menlo as the managing partner, our development strategy includes entitlement, ground-up development and redevelopment from concept through site acquisition, construction, lease up and exit.

- Driving growth through ground-up development and build-to-suit for leading technology firms

- Menlo’s vertically integrated platform drives the entire development process from site acquisition, planning, entitlements, design, construction management and disposition

- In-house operations enable us to quickly adapt to the market cycle and market trends, ensuring we are well positioned to execute our investment strategy

- Focus on infill locations

- Target leverage: 60% to 75% LTV